Are you familiar with this scenario?

You’ve put your heart and soul into growing your business, fueled by sheer determination and relentless effort. You’ve cultivated loyal customers, fine-tuned your products and services, and managed your finances diligently.

You have product and service lines, supply chains, customers whom you W0W, and cash is coming in the door.

All your hard work to drive the business has paid off and you can feel the motion of your business.

AND YET…?

Despite all your hard work, you find yourself facing these challenges:

- An ever-dwindling bank balance.

- Decision-making that often feels more instinctual than fact-based.

- Resistance to talking with your finance team and/or looking at anything finance-based

- Difficulty in gauging your business’s true health due to incorrect financial records.

- Hesitation to bring on vital team members due to long-term financial concerns.

NOW, ENVISION A WORLD WHERE YOU CAN

- Lead a proactive team that solves problems and keeps your vision on track.

- Hire new team members with confidence knowing your cash flow is secure.

- Step back from the daily grind while staying more connected than ever.

- Monitor your business on a real time basis, quickly showing you which activities are on track and off track.

- Go directly to the root cause of your problems and establish clearer accountability and communication.

CFO vs. Fractional CFO Support

In today’s world, the traditional notion that every business should have a full-time Chief Financial Officer is costly and outdated.

Early-stage businesses need flexibility and cost-effective solutions.

CFOs are actively implementing strategies to counteract potential threats from macroeconomic factors, including inflation and workforce shortages.

Would it be nice to have a full executive team on payroll?

Sure.

Is it necessary, this early in your business?

Probably not.

That’s why I’ve designed this turn-key program that meets you where you are, providing the essential insights you need to make informed decisions without risking late payroll or financial uncertainty.

Feel confident with the security of knowing you’ve got the must-have essentials every business needs from a CFO birds-eye view packaged in a proven model and with step-by-step support and tools.

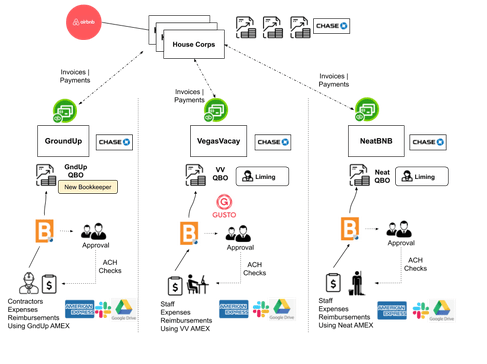

HOW WE TRANSFORMED AirREI’s FINANCIAL MANAGEMENT SYSTEMS

Background: AirREI, a Las Vegas-based business managing 23 Airbnb properties, faced significant financial challenges when we embarked on this transformative journey together. Their existing financial processes were riddled with inefficiencies, bookkeeping errors, payroll delays, and investor inquiries that the CEO struggled to address. The financial administrator, overwhelmed and undertrained, grappled with an unsustainable workload, often exceeding 70-80 hours per week. Rather than utilizing dedicated accounting software, the company relied on Google Sheets, while payments were dispersed through platforms like Zelle and PayPal without proper tracking mechanisms.

The Intervention: Our team undertook a comprehensive overhaul of AirREI’s financial management systems, aiming to establish a more streamlined and organized workflow. The transformation effort was multifaceted and included the following key aspects:

Efficient Bookkeeping: We introduced best-in-class accounting software to replace Google Sheets, ensuring accurate and organized financial records.

Timely Payroll: Implementing automated payroll systems ensured employee compensation was consistently processed on schedule, alleviating stress and enhancing employee satisfaction.

Investor Relations: We introduced transparent reporting mechanisms, providing investors with the insights they sought and empowering the CEO to address their inquiries confidently.

Secure Payment Processing: The adoption of a secure and traceable payment platform streamlined financial transactions, reducing the risk associated with untracked payments.

Reduced Workload: With the new systems in place, the financial administrator’s workload was significantly reduced, leading to improved work-life balance and increased productivity.

Results

The transformation of AirREI’s financial management systems has yielded impressive results, painting a stark contrast to the challenges the business previously faced. The current state of their financial systems is marked by efficiency, accuracy, and organization. The outcomes of our intervention include:

- Streamlined Operations: AirREI now enjoys a seamless and efficient financial workflow, saving time and resources.

- Improved Investor Confidence: Transparent reporting has strengthened investor trust and confidence in the company’s financial management.

- Reduced Work Hours: The financial administrator’s work hours have been substantially reduced, improving both productivity and well-being.

- Enhanced CEO Insight:The CEO is now equipped with the information needed to confidently respond to investor inquiries.

- Enhanced Security:Secure payment processing safeguards financial transactions.

The transformation of AirREI’s financial management systems is a testament to the positive impact that efficient and organized financial processes can have on a business. This case study underscores the importance of proactive intervention and strategic planning in overcoming financial challenges and achieving sustainable growth.

Pricing and Offers

ESTABLISHED

(mid 7-figure +)

PRIVATE ONE-ON-ONE SUPPORT

YOU CAN’T CHANGE THE PAST BUT YOU CAN TAKE CONTROL OF YOUR FUTURE…

Hi, I’m Robert.

Reflecting on my journey, it feels like every twist and turn in my life prepared me for this calling.

My upbringing was enriched by parents who excelled in their entrepreneurial endeavors, and this environment ignited a deep passion for business within me from an early age. Today, I stand at the helm of a thriving consulting business, dedicated to empowering entrepreneurs like you to navigate the intricacies of the financial landscape.

My personal journey has seen me soar to the heights of building a prosperous business, marked by a 7-figure exit, and descend to the depths of strenuous burnout and significant financial setbacks. My consulting business boasts an annual revenue of $700K with extensive experience supporting women-run businesses. This achievement means even more, considering it’s been eight years since I last bid farewell to a client. Furthermore, the business continues its remarkable trajectory, all achieved without the need for additional personnel.

My mission is to serve as your trusted compass on the path to financial clarity and abundance. My heart swells with pride when I see my clients thrive because their success is a testament to the purpose behind my work.

Allow me to share a secret: what drives me most is witnessing the transformation of small businesses as they break free from self-imposed constraints, conquer their fears, and transcend the limitations of scarcity, thereby unlocking a world of boundless possibilities.

My greatest desire is to see your business among those who have embarked on this remarkable journey toward success. …and I want your business to be one of them…

What clients are saying

Tired of making decisions based on assumptions?

Begin your financial empowerment with my library of free resources.